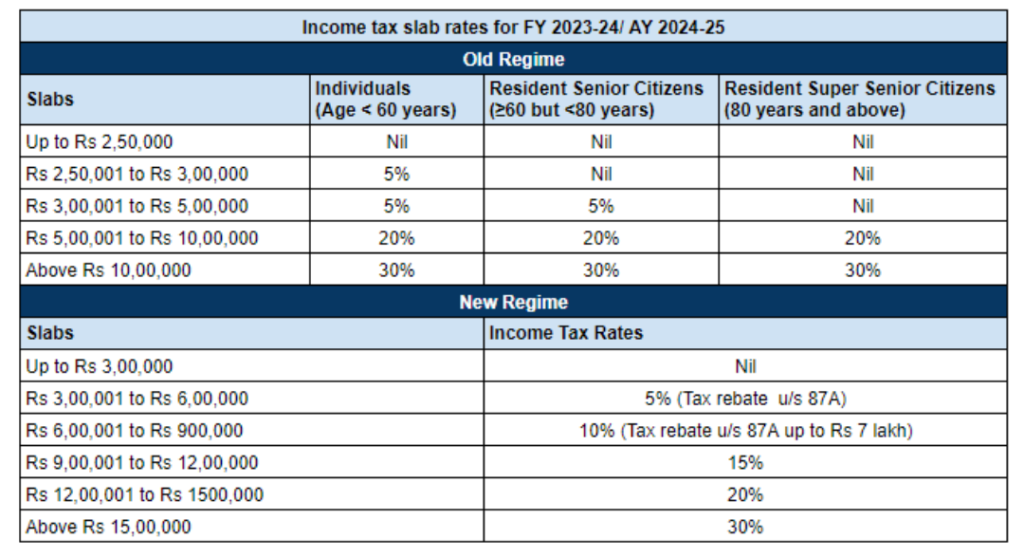

The income tax slab rates differ between the old and new tax regimes. Furthermore, the old tax regime divided the slab rates into three categories.

- Indian Residents aged < 60 years + All the non-residents

- 60 to 80 years of age: Resident Senior citizens

- More than 80 years: Resident Super senior citizens.

- What Is Income Tax Slab?

- Income Tax Slab Rates For FY 2022-23 (AY 2023-24)

- Comparison of tax rates under New tax regime & Old tax regime for FY 2022-23 (AY 2023-24) and FY 2023-24 (AY 2024-25)

- Revised Income Tax Slab Rate FY 2023-24 (AY 2024-25) – For New Regime

- Important points to note if you select the new tax regime

- Conditions for opting new tax regime

- Comparison of Income Tax Slabs under New Regime before and after budget

- Example for Old Tax regime Vs New Tax regime? Which is better?

- When can I opt for old vs new regime?

- Want to File Income Tax Return (In Most Beneficial Tax Regime) Contact Our Experts

What Is Income Tax Slab?

Individuals in India are taxed based on a slab system, with different tax rates assigned to different income ranges. Tax rates rise in lockstep with an individual’s income. This type of taxation allows the country to have a fair and progressive tax system. The income tax slabs are updated on a regular basis, usually during each budget. These slab rates differ for different taxpayer groups. Let us look at all of the slab rates for FY 2022-23 (AY 2023-24) and FY 2023-24 (AY 2024-25).

Income Tax Slab Rates For FY 2022-23 (AY 2023-24)

A. New Tax regime

| Income Slabs | Income Tax Rates |

| ₹0 – ₹2,50,000 | – |

| ₹2,50,000 – ₹5,00,000 | 5% (Tax rebate u/s 87A is available) |

| ₹5,00,000 – ₹7,50,000 | 10% |

| ₹7,50,000 – ₹10,00,000 | 15% |

| ₹10,00,000 – ₹12,50,000 | 20% |

| ₹12,50,000 – ₹15,00,000 | 25% |

| >₹15,00,000 | 30% |

B. Old Tax regime (Rates are Same in FY 2023-24)

a. Income tax slabs for individual aged below 60 years & HUF

| Income Slabs | Individuals Below The Age Of 60 Years and NRIs |

|---|---|

| Up to Rs 2.5 lakh | NIL |

| Rs 2.5 lakh – Rs 5 lakh | 5% |

| Rs 5 lakh – Rs 10 lakh | 20% |

| > Rs 10 lakh | 30% |

NOTE:

- Income tax exemption limit is up to Rs 2,50,000 for Individuals, HUF below 60 years aged and NRIs.

- Surcharge and cess will be applicable as discussed above.

b. Income tax slab for individual aged above 60 years to 80 years

| Income Slabs | Tax Slabs for Senior Citizens (Aged 60 Years But Less Than 80 Years) |

|---|---|

| Rs 0 – Rs 3 lakh | NIL |

| Rs 3 lakh – Rs 5 lakh | 5% |

| Rs 5 lakh – Rs 10 lakh | 20% |

| > Rs 10 | 30% |

NOTE:

- Income tax exemption limit is up to Rs.3 lakh for senior citizens aged above 60 years but less than 80 years.

- Surcharge and cess will be applicable as discussed above.

c. Income tax slab for Individual aged more than 80 years

| Income Slabs | Income Tax Slab for Super Senior Citizens (Aged 80 Years And Above) |

|---|---|

| Rs 0 – Rs 5 lakh* | NIL |

| Rs 5 lakh – Rs 10 lakh | 20% |

| > Rs 10 lakh | 30% |

NOTE:

- Income tax exemption limit is up to Rs 5 lakh for super senior citizen aged above 80 years.

- Surcharge and cess will be applicable as discussed above.

Comparison of tax rates under New tax regime & Old tax regime for FY 2022-23 (AY 2023-24) and FY 2023-24 (AY 2024-25)

Slabs | Old Tax Regime | New Tax Regime | |||

| <60 years & NRIs | >60 to <80 years | > 80 years | FY 2022-23 | FY 2023-24 | |

| ₹0 – ₹2,50,000 | NIL | NIL | NIL | NIL | NIL |

| ₹2,50,000 – ₹3,00,000 | 5% | NIL | NIL | 5% | NIL |

| ₹3,00,000 – ₹5,00,000 | 5% | 5% (Tax rebate u/s 87A is available) | NIL | 5% | 5% |

| ₹5,00,000 – ₹6,00,000 | 20% | 20% | 20% | 10% | 5% |

| ₹6,00,000 – ₹7,50,000 | 20% | 20% | 20% | 10% | 10% |

| ₹7,50,000 – ₹9,00,000 | 20% | 20% | 20% | 15% | 10% |

| ₹9,00,000 – ₹10,00,000 | 20% | 20% | 20% | 15% | 15% |

| ₹10,00,000 – ₹12,00,000 | 30% | 30% | 30% | 20% | 15% |

| ₹12,00,000 – ₹12,50,000 | 30% | 30% | 30% | 20% | 20% |

| ₹12,50,000 – ₹15,00,000 | 30% | 30% | 30% | 25% | 20% |

| >₹15,00,000 | 30% | 30% | 30% | 30% | 30% |

Revised Income Tax Slab Rate FY 2023-24 (AY 2024-25) – For New Regime

| Income Slabs | Income Tax Rates FY 2023-24 (AY 2024-25) |

| Up to Rs 3,00,000 | Nil |

| Rs 3,00,000 to Rs 6,00,000 | 5% on income which exceeds Rs 3,00,000 |

| Rs 6,00,000 to Rs 900,000 | Rs. 15,000 + 10% on income more than Rs 6,00,000 |

| Rs 9,00,000 to Rs 12,00,000 | Rs. 45,000 + 15% on income more than Rs 9,00,000 |

| Rs 12,00,000 to Rs 1500,000 | Rs. 90,000 + 20% on income more than Rs 12,00,000 |

| Above Rs 15,00,000 | Rs. 150,000 + 30% on income more than Rs 15,00,000 |

Important points to note if you select the new tax regime

- Please note that the tax rates in the New tax regime is the same for all categories of Individuals, i.e. Individuals, Senior citizens and Super senior citizens.

- Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u/s 87A i.e. tax liability will be NIL in both regimes.

*In Budget 2023, rebate under new regime has been increased and therefore, income upto Rs 7 lakh will be tax-free from FY 2023-24. - Surcharge: In case the income exceeds a certain threshold, surcharge will be applicable

- Surcharge rates are as below:

- 10% of Income tax if total income > Rs.50 lakh

- 15% of Income tax if total income > Rs.1 crore

- 25% of Income tax if total income > Rs.2 crore

- 37% of Income tax if total income > Rs.5 crore

*In Budget 2023, the highest surcharge rate of 37% has been reduced to 25% under the new tax regime. (applicable from 1st April 2023)

- Surcharge rates of 25% or 37%, will not be applicable to the income which is taxable under sections 111A (Short Term Capital Gain on Shares), 112A (Long Term Capital Gain on Shares), and 115AD (Tax on income of Foreign Institutional Investors). Therefore, the highest surcharge rate on the tax payable for such incomes will be 15%.

- From Assessment Year 2023-24, the maximum surcharge rate on tax payable for dividend income or capital gain mentioned in Section 112 will be 15%. The surcharge rate for an Association of Persons (AOP) consisting entirely of companies will also be limited to 15%.

- Surcharge rates are as below:

- Additional Health and Education cess at the rate of 4% will be added to the income tax liability + surcharge in all cases.

Conditions for opting new tax regime

Taxpayers who choose concessional rates under the New Tax regime will lose certain exemptions and deductions available under the old tax regime. There are a total of 70 prohibited deductions and exemptions, the most commonly used of which are listed below:

| Particulars | Old Tax Regime | New Tax regime (until 31st March 2023) | New Tax Regime (From 1st April 2023) |

| Income level for rebate eligibility | ₹ 5 lakhs | ₹ 5 lakhs | ₹ 7 lakhs |

| Standard Deduction | ₹ 50,000 | – | ₹ 50,000 |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 5 lakhs | ₹ 7.5 lakhs |

| Rebate u/s 87A | 12,500 | 12,500 | 25,000 |

| HRA Exemption | ✓ | X | X |

| Leave Travel Allowance (LTA) | ✓ | X | X |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day | ✓ | X | X |

| Standard Deduction (Rs 50,000) | ✓ | X | ✓ |

| Entertainment Allowance Deduction and Professional Tax | ✓ | X | X |

| Perquisites for official purposes | ✓ | ✓ | ✓ |

| Interest on Home Loan u/s 24b on slef-occupied or vacant property | ✓ | X | X |

| Interest on Home Loan u/s 24b on let-out property | ✓ | ✓ | ✓ |

| Deduction u/s 80C (EPF|LIC|ELSS|PPF|FD|Children’s tuition fee etc) | ✓ | X | X |

| Employee’s (own) contribution to NPS | ✓ | X | X |

| Employer’s contribution to NPS | ✓ | ✓ | ✓ |

| Medical insurance premium – 80D | ✓ | X | X |

| Disabled Individual – 80U | ✓ | X | X |

| Interest on education loan – 80E | ✓ | X | X |

| Interest on Electric vehicle loan – 80EEB | ✓ | X | X |

| Donation to Political party/trust etc – 80G | ✓ | X | X |

| Savings Bank Interest u/s 80TTA and 80TTB | ✓ | X | X |

| Other Chapter VI-A deductions | ✓ | X | X |

| All contributions to Agniveer Corpus Fund – 80CCH | ✓ | Did not exist | ✓ |

| Deduction on Family Pension Income | ✓ | ✓ | ✓ |

| Gifts up to Rs 50,000 | ✓ | ✓ | ✓ |

| Exemption on voluntary retirement 10(10C) | ✓ | ✓ | ✓ |

| Exemption on gratuity u/s 10(10) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment u/s 10(10AA) | ✓ | ✓ | ✓ |

| Daily Allowance | ✓ | ✓ | ✓ |

| Transport Allowance for a specially-abled person | ✓ | ✓ | ✓ |

| Conveyance Allowance | ✓ | ✓ | ✓ |

Comparison of Income Tax Slabs under New Regime before and after budget

Only the Income tax slabs under the new regimes were revised in the recent Union Budget 2023.

| Slab | New Tax Regime FY 2022-23 (AY 2023-24) | New Tax Regime FY 2023-24 (AY 2024-25) |

| ₹0 – ₹2,50,000 | – | – |

| ₹2,50,000 – ₹3,00,000 | 5% | – |

| ₹3,00,000 – ₹5,00,000 | 5% | 5% |

| ₹5,00,000 – ₹6,00,000 | 10% | 5% |

| ₹6,00,000 – ₹7,50,000 | 10% | 10% |

| ₹7,50,000 – ₹9,00,000 | 15% | 10% |

| ₹9,00,000 – ₹10,00,000 | 15% | 15% |

| ₹10,00,000 – ₹12,00,000 | 20% | 15% |

| ₹12,00,000 – ₹12,50,000 | 20% | 20% |

| ₹12,50,000 – ₹15,00,000 | 25% | 20% |

| >₹15,00,000 | 30% | 30% |

Example for Old Tax regime Vs New Tax regime? Which is better?

The new tax regime will primarily benefit middle-class taxpayers earning up to Rs 15 lakh in taxable income. For high-income earners, the old regime is a better option.

People who make small investments will benefit from the new income tax regime. Because the new regime includes seven lower-income tax brackets, anyone paying taxes without claiming tax deductions can benefit from paying a lower tax rate under the new regime. For example, under the old system, an assessee with a total income before deduction of up to Rs 12 lakh will have a higher tax liability if their investments are less than Rs 1.91 lakh. Choose the new regime if you invest less in tax-saving schemes.

That being said, if you already have a financial plan in place for wealth creation, such as investing in tax-saving instruments, purchasing mediclaim and life insurance, paying children’s tuition fees, paying EMIs on education loans, purchasing a home with a home loan, and so on, the old regime benefits you with higher tax deductions and lower tax outgo.

Given the foregoing and the new income tax regime, taxpayers may compare both regimes if they want to take advantage of the lower tax rates. As a result, it is best to conduct a comparative evaluation and analysis under both regimes before deciding on the most advantageous one, which may differ from person to person.

When can I opt for old vs new regime?

| Nature of Income | Time of Selection of option of old vs new regime |

|---|---|

| Income from Salary or any other head of income attracting TDS | At the start of the financial year, an employee has the choice to select the new tax regime and inform their employer. It cannot be modified during the year. However, the option can be modified when filing the Income Tax Return. |

| Income from Business & Profession | In case you have Business or profession income, the choice between tax regimes for can only be made once in a lifetime. |

Want to File Income Tax Return (In Most Beneficial Tax Regime) Contact Our Experts

Disclaimer: Please note that the content provided in this article is for educational purposes only and represents the author’s point of view. It is crucial to consult with a qualified financial advisor or tax professional before making any decisions based on the information provided. Your unique financial situation may require personalized guidance, and professional advice ensures accurate decision-making tailored to your specific needs.